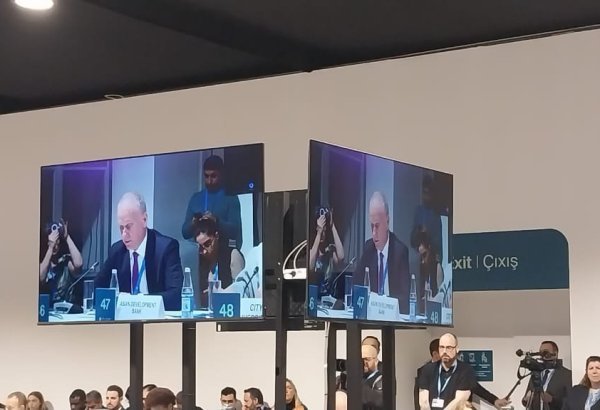

BAKU, Azerbaijan, October 23. The Asian Development Bank (ADB) has developed its own new financial products, newly appointed ADB Country Director for Azerbaijan Sunniya Durrani-Jamal said in a statement at the conference on "Innovative Solutions for Sustainable Microfinance" today in Baku, TurkicWorld reports.

Durrani-Jamal emphasized that financial inclusion for underserved and vulnerable communities, as well as access to finance for small and medium-sized enterprises, is a crucial part of the ADB's strategy for job creation, income enhancement, and poverty reduction.

"Since 2010, the ADB has launched a major microfinance program, providing support for loans of about $1.8 billion and attracting $881 million in co-financing. We have provided microloans to more than 10 million borrowers, with 98 percent of our borrowers being women," she said.

Durrani-Jamal highlighted that the ADB offers consultations to improve regulatory practices that foster responsible market growth, enhance outreach, and improve services.

"This includes new services such as payment solutions, savings products, microinsurance, and new service delivery mechanisms, such as branchless banking and mobile banking. The ADB has provided such consultations to the government of Azerbaijan, including the Central Bank.

Additionally, the ADB offers trade and supply chain financing. We also collaborate directly with microfinance institutions through direct loans, risk-sharing agreements, or guarantees that enable them to expand their operations. As a climate bank for Asia and the Pacific, we understand that in the event of a disaster, the balance sheets of microfinance institutions suffer, hindering their ability to respond to the financing needs of communities for recovery. Therefore, we have developed our new financial products, such as solutions for disaster risk financing, which we also promote among our clients and agencies," she added.